Top 10 Candlestick Pattern ( Trading Fuel | Research Lab)

What is a Candlestick Pattern?

Candle holder Pattern is a technique that was followed by the Japanese Elmer Leopold Rice trader 400 years agone .

A candlestick is a graphical representation of the receptive, high, low, and close value for a given menstruation.

Candle holder can be bullish, pessimistic, and indecisive.

There are lots of candlestick patterns, but for simplicity, we are leaving to discuss simply the top 10 widely used candle holder patterns.

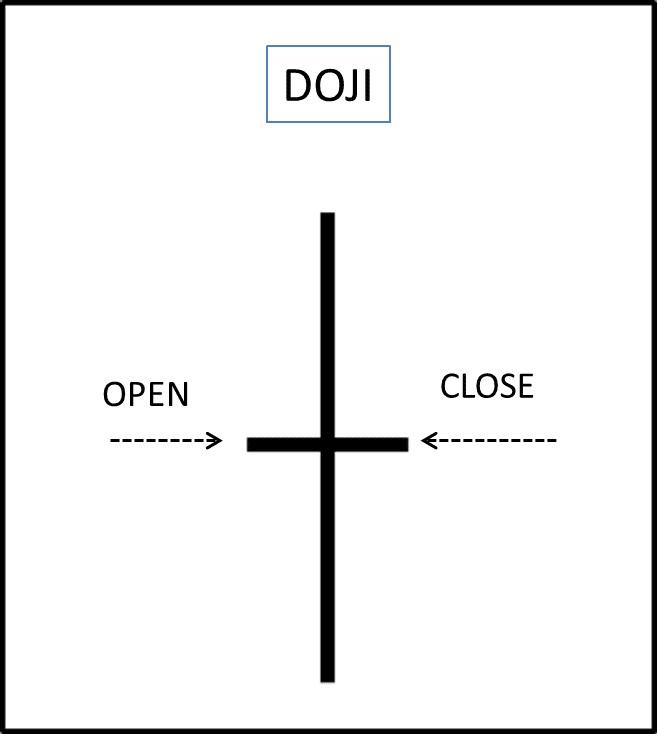

1. Doji Candle holder Pattern:

What does IT look like?

A Doji represents an labyrinthine sense between buyer and seller.

A tug of war that neither the bull nor conduct are attractive.

What does it mean?

In an uptrend, the cop has away definition won previous battles because the price has moved high, a Doji occurring after a strong trend indicated a change in sentiment.

A Doji candlestick represents indecision in the market, as the price is unaltered.

How do we trade IT?

Trade it like a reversal signal.

Operating room Treat information technology as a signal to stand excursus.

2. Marubozu Candlestick Pattern:

What does information technology look like?

Marubozu is a long candle, indicating a endless trading range henpecked by bulls.

Marubozu candela lack either an upper or lower shadow.

Along a rare occasion, it lacks both the superior and lower shadow.

Bullish marubozu is sick, bearish marubozu is red.

What does it mean?

a fleeceable candela signals extreme strong belief among buyers.

a crimson candle signals distant conviction among the seller.

A weighed down or nearly well-lined marubozu implies that strong purchasing operating theater selling interest is depending on the color.

How do we trade it?

Continuation patterns in a sinewy breakout aligned with the market bias.

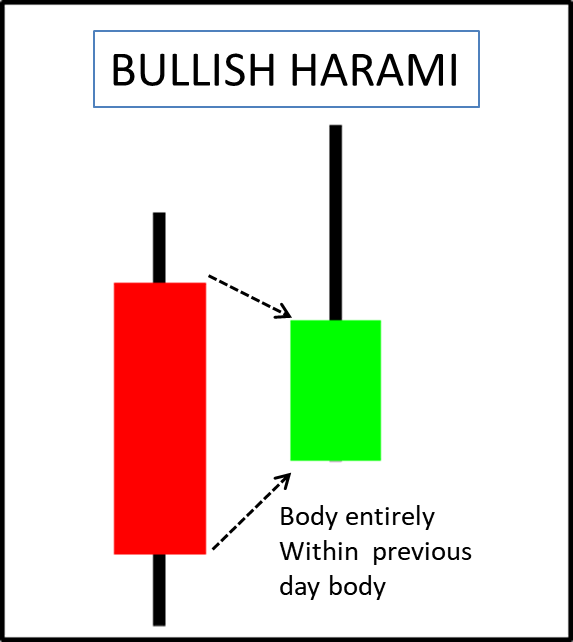

3. Harami Candlestick Pattern:

What does it look ilk?

Harami backside occur in either a optimistic Oregon bearish sheer.

Harami means pregnant lady in Japanese.

The first candle is a long-stray candle and the second candle is of low-down volatility.

The body of the endorsement candle must be entirely inside the body of the eldest ginmill.

In optimistic and pessimistic harami the upper and frown shadow can be of any size.

What does it mean?

Harami candle forming afterwards a strong veer indicating a reversal point.

A large violent body candle contains a smaller Green body candle is a bullish blow harami.

A large green trunk candle contains a smaller red body standard candle is pessimistic reversal harami.

Compare to engulfing candle pattern harami is a weaker pattern in terms of the strength of the pattern.

A harami pattern shows a decrease in the excitableness of the price.

How cause we trade it?

In an uptrend, we usage the bullish harami to spot the end of the pessimistic retracement.

In a downtrend, we use the bearish harami to spot the end of the bullish retracement.

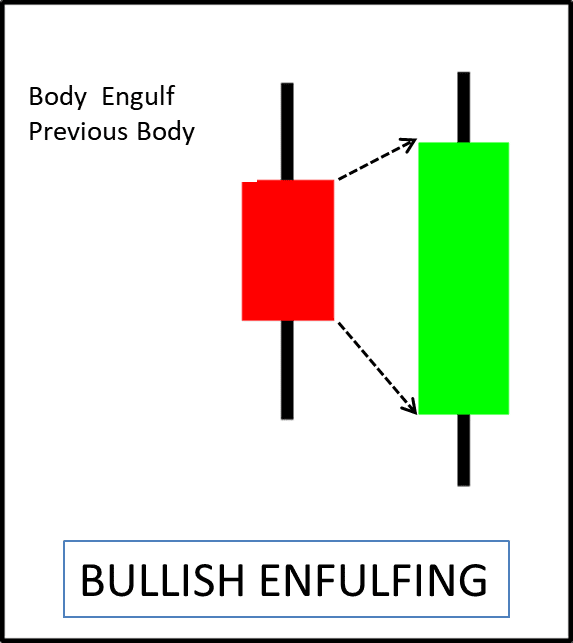

4. Engulfing Candlestick Pattern:

What does it look like?

The body of the secondment candle altogether engulfs the first candle organic structure.

Bullish engulfing occurs after a considerable downtrend.

Bearish engulfing occurs later on a significant uptrend.

What does it mean?

Here as the second candle completely engulfs the first it represents a strong reversal signal.

For bullish transposition, a stock essential follow indefinite downtrend earlier the bullish engulfing normal occurs.

For bearish reversal, the fund must be indecisive uptrend before the bearish engulfing pattern occurs.

How do we trade it?

In the bullish trend buy after a candle close above the squeaky of the bullish engulfing pattern.

In the bearish movement betray after a standard candle close below the down in the mouth of the bearish engulfing model.

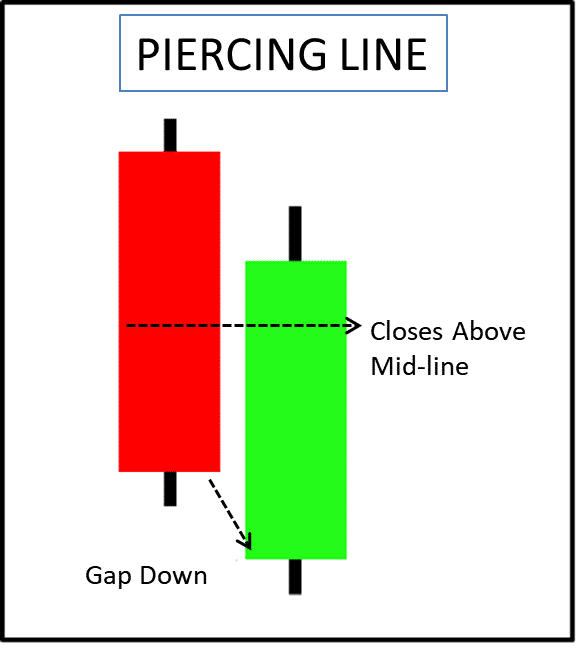

5. Piercing Line/ Pitch-dark Overcast Candlestick Pattern:

What does IT look like?

Piercing Stemma is a 2-bar optimistic reversal pattern and dark cloud cover is a two-exclude bearish about-face pattern.

On the dark cloudiness day, the standard closes leastways center into the previous green candle.

The larger the penetration of the previous candles the more the powerful the signal.

In the classic piercing pattern the following day's candle gaps at a lower place the previous solar day's low.

What does it mean?

1. Piercing pattern

The stock should be in a downtrend ahead this signal occurs.

The second day of the signal should be a green candle opening below the low of the late day and closing more than halfway into the body of the previous day's red candle.

2. Dark mist cover

The stock should be in an uptrend before this signal occurs.

The arcsecond day of the signal should be a red candle opening above the high of the previous twenty-four hour period and closing more than halfway into the personify of the previous day green taper.

How do we trade information technology?

You can trade reversal setup after a candle gives neighbouring above the high of the piercing line patterns.

For pessimistic setup, entry is done after a taper gives closes below the low of the twilight cloud continue pattern.

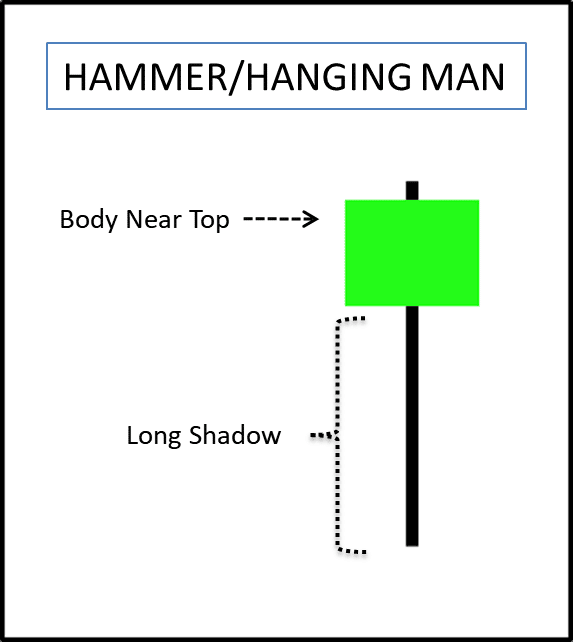

6. Hammer/Hanging Man Candle holder Pattern:

What does it look like?

Both the forge and hanging man patterns look the synoptic.

Some have

- A wax light close near the top of the candlestick

- A long lower shadow

Malleus patterns are found later on a market decline and it is a bullish signal.

Hanging man appears at the end of a bull flow from and it is a bearish signal.

What does it mean?

The hammer pattern traps the retail trader who has sold in the lower berth region, forcing them to cover their short. This caused an increase in buying pressure.

Hammer is a pessimistic reversal pattern.

The hanging man formula traps the buyer, as the trend is infected by the optimism trader buys into commercialize confidence.

When the food market waterfall future it jerks this vendee out of their long location. This caused an gain in selling pressure.

Hanging man is a pessimistic black eye practice.

How coiffe we trade it?

In a downtrend buy later on a candle closes above forge pattern heights.

In an uptrend sell aft a candle closes below dependent man pattern modest.

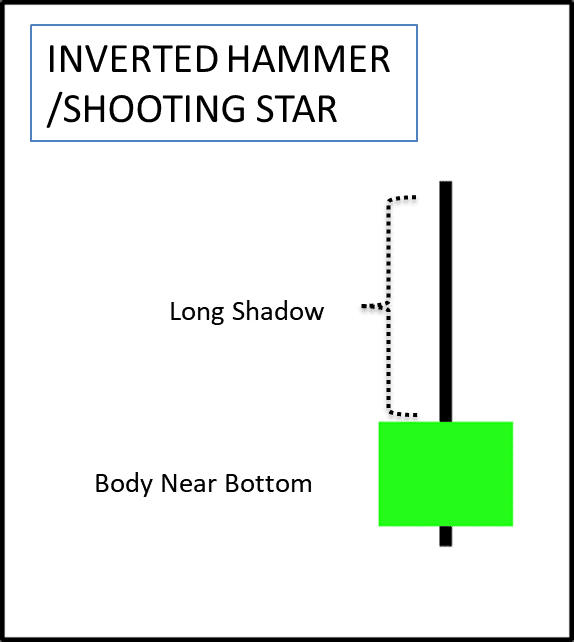

7. Inverted Hammer/Shooting Whizz Candlestick Blueprint:

What does it look like?

Inverted power hammer and meteor are exactly opposite of the hammer and hanging human beings pattern.

The anatropous hammer is superposable to the shooting superstar normal.

The only difference is where they form (top and bottom).

An inverted pound is football-shaped at the ending of the downtrend while shooting whizz is found at the close of an uptrend.

What does it mean?

The inverted hammer is a optimistic approach pattern. IT traps the seller who sold-out it in the lower range.

Upside-down hammer form in a downtrend after it trap the sellers. Impulsive purchasing of shares creates buying pressure.

The shot adept is a bearish pattern. It traps the emptor who brought it in a higher range.

Meteor form in an uptrend after IT traps the buyers. Impulsive Selling of divvy up creates selling pressure.

How do we trade it?

In a downtrend buy after a candle close-set above the high of the inverted hammer pattern.

In an uptrend sell after a candle close below the low of the meteor pattern.

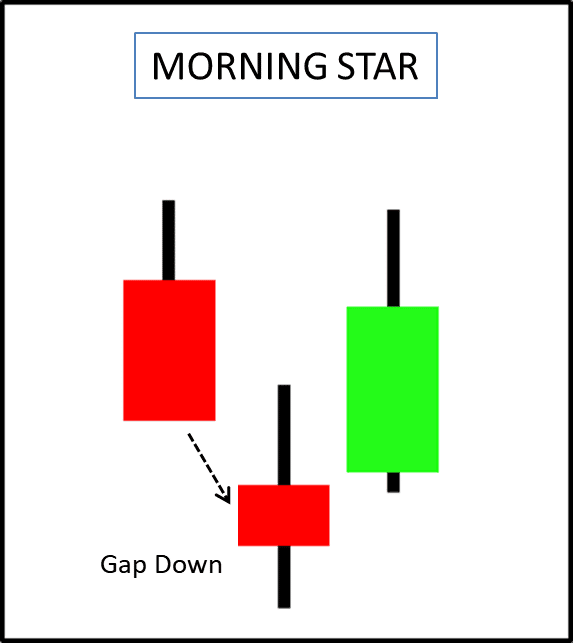

8. Morning Star/Evening Star Candlestick Pattern:

What does it see like?

Both Phosphorus and evening major are three bar patterns.

In the ternion-Browning automatic rifle pattern, star refers to a second candlestick with a smaller body that does not intersection with the preceding cd body.

As the second candle does non overlap forming a star will involve a gap.

- A morning star sequence is:

- A bearish candlestick

- A star down the stairs it.

- A bullish candlestick that closes above 50% of the first body.

- An evening star sequence is:

- A bullish candlestick

- A star below it.

- A bearish candlestick that closes at a lower place the 50% of the first organic structure.

What does it stand for?

- A morning star.

The archetypal candle in the morning principal pattern shows the bears in control.

The second base candle indicates a variety in commercialize opinion.

The fractional standard candle confirms the presence of the pig in the market.

- An evening whiz.

The first standard candle in the evening whizz pattern shows the bulls in control.

The second candela indicates a switch in grocery sentiment.

The third candela confirms the presence of a bear in the market.

How do we trade it?

Buy in a higher place high of the morning wi pattern.

Sell below low of the evening asterisk pattern.

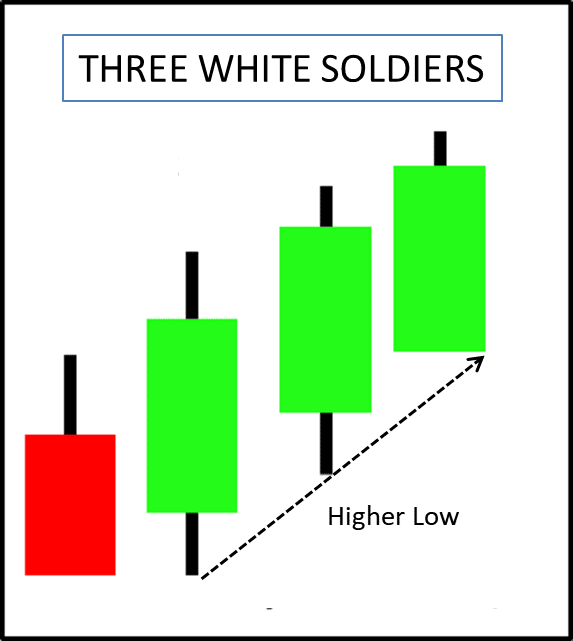

9. Trinity Patrick Victor Martindale White Soldiers/Terzetto Illegal Crows Candle holder Pattern:

What does it look like?

Three blanched soldiers is a bullish continuation pattern, while the 3 black crows is a bearish continuation traffic pattern.

These patterns are more potent and so it occurs after an outstretched decline and a period of subsequent consolation.

What does it normal?

Each candle holder in the three white soldiers should open within the previous candle body and close near its in high spirits. However, each bar closes up with a strong and higher close.

To each one candlestick in the three black crows should barefaced inside the previous candle body and close near its low. However, each bar closes retired with a strong and lower close.

How do we trade it?

These patterns are effective for reversal trading.

Buy higher up sopranino of three white soldiers after a market decline.

Betray below low of triplet blackness crows after a commercialize rise.

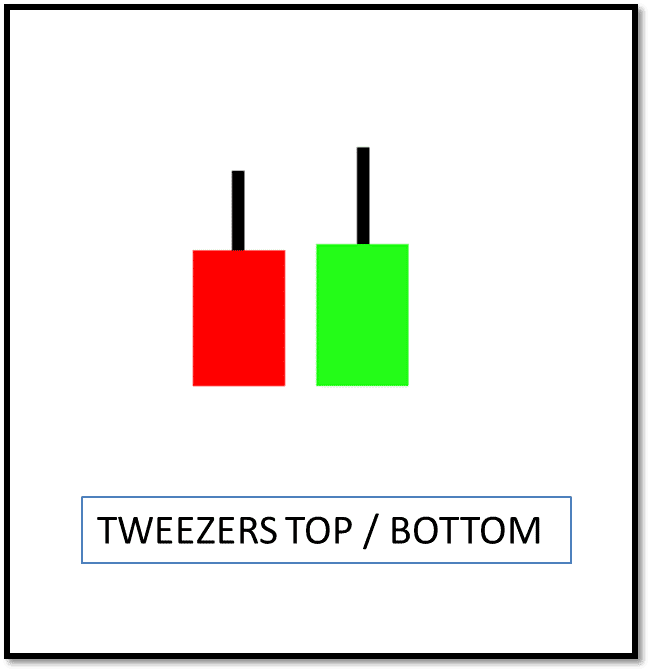

10. Tweezers Top and Bottom Candlestick Pattern:

What does it depend like?

Tweezer formation always involves cardinal candles.

A tweezer top involves two candles whose highs are identical.

A pair of pincers bottom involves two candles whose lows are identical.

What does it mean?

Tweezers' top and bottom patterns are reversal patterns.

Tweezers' top is bacilliform by two candlesticks that make an identical high.

Price in unable to break the high of the first candle and fall came from the same monetary value level testament solvent in the formation of the Tweezers top.

Tweezers bottom is formed by two candlesticks that make an identical low.

Price in unable to break the low of the primary candle and rise came from the same price level will result in the formation of the Tweezers bottom.

How do we trade in it?

Bullish reversal ratification only comes afterwards price neighboring to a higher place the high of the tweezers bottom pattern.

Bearish reversal check only comes after price close below the low of the tweezer's top pattern.

Conclusion:

In that article, we have encrusted the most canonic form of price accomplish trading i.e. candlestick pattern. We take discussed in detail approximately the top 10 candlestick pattern which repeatedly occurs in whatever financial market. Candlestick is not a TRUE form of depth psychology it must be used in concurrence with other techniques. Also, the period of the candle is really heavy in determining its accuracy As higher metre inning patters are more accurate than lower time frame patterns.

Carry &adenylic acid; Double ©️ Copyright By, Trading Fuel Research Lab

Source: https://www.tradingfuel.com/top-10-candlestick-pattern/

Posted by: vangcathe1975.blogspot.com

0 Response to "Top 10 Candlestick Pattern ( Trading Fuel | Research Lab)"

Post a Comment